Wealthsimple review 2021

A perfect start for a beginner investor

This post may contain affiliate links.

I have been “planning” to invest in the stock market since 2012, and I finally invested in 2018 after my friend introduced me to Wealthsimple.

What is Wealthsimple?

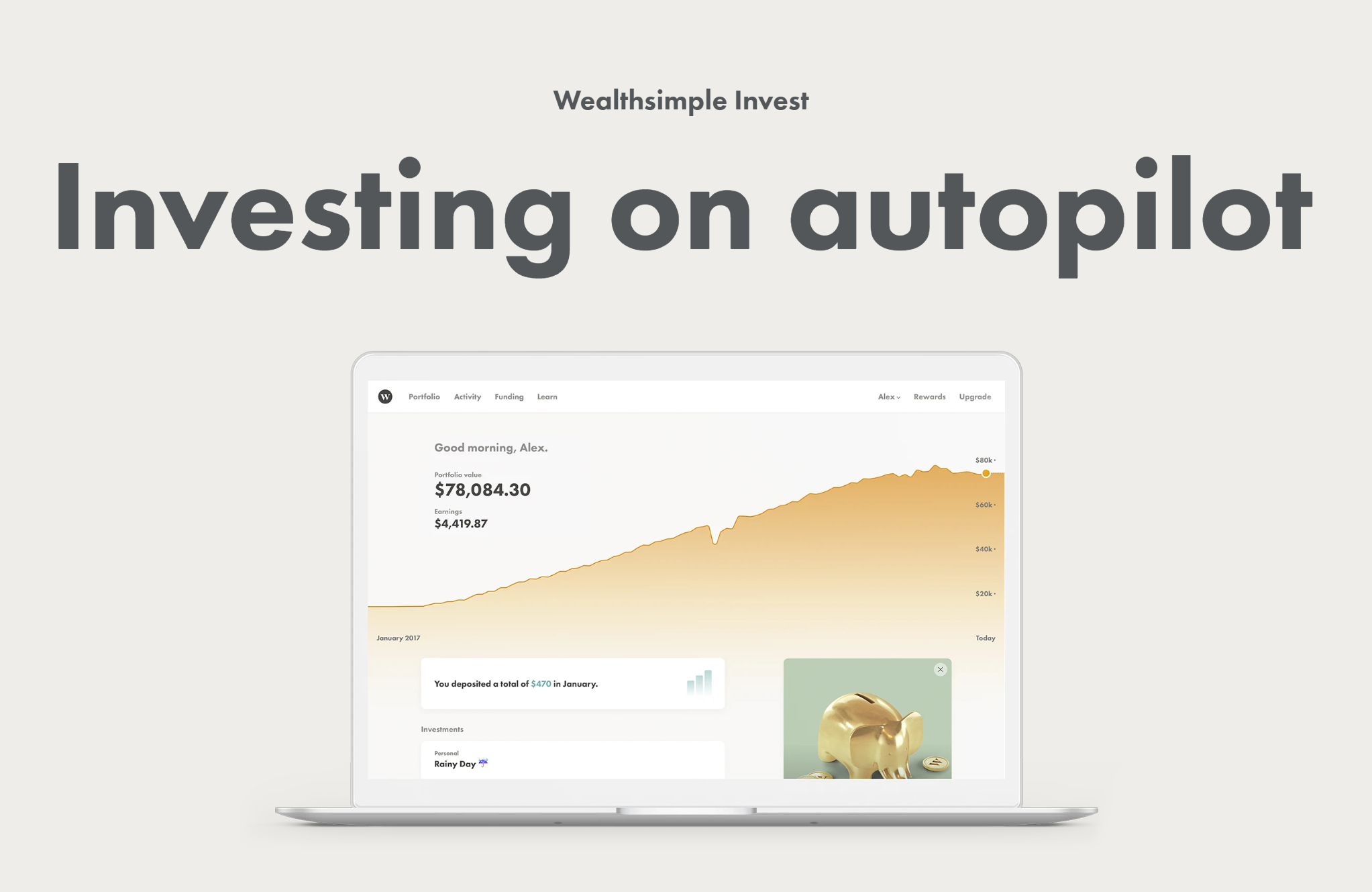

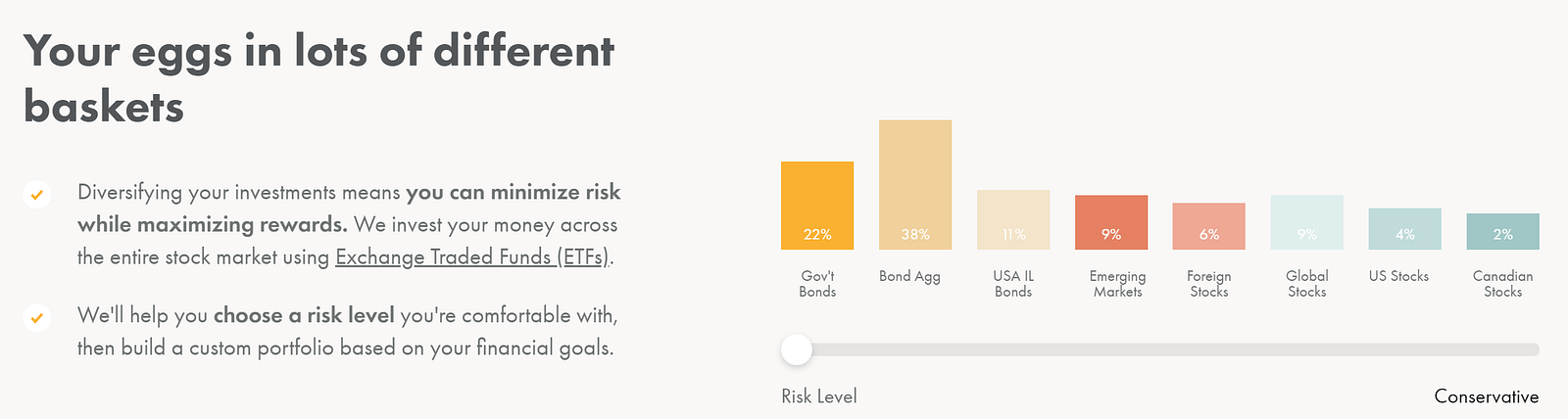

Wealthsimple is a Robo-advisor that provides long-term automated investment. It conveniently removes the middle man to offer you low-cost exchange-traded funds (ETFs). Wealthsimple acts as a financial advisor, and all you have to do is set-up an account, and they’ll take care of the rest!

In this review, I will go over my experience of using it and tell you what is needed!

Wealthsimple is best for:

- No minimum fees

- User-friendly platform

- The team have tons of industry experiences

- Management expense ratios are lowest among competitors

- Have an option for Halal and Socially Responsible funds

- Access to human account managers

But first, let’s talk about the service.

These are a few of the main things you need to know about the service to get started.

Security

The service uses 256-bit SSL/TLS certificate encrypts all information transmitted between your browser and their web servers. This basically means that the service is doing everything to make your money safe.

The service also uses two-factor authentication. I love that it has not failed me yet. The service asks to renew the one-time password (OTP) code every 30 days, and I do appreciate the extra care the company takes with my hard-earned money.

In simple terms, Yes, your money is safe with Wealthsimple. Canadian ShareOwner Investments Inc., Wealthsimple’s custodial broker, is regulated by IIROC and is a member of the Canadian Investor Protection Fund (CIPF). Your money is held at their custodial broker. Your account is protected up to $1M if the brokerage were to go insolvent. For more information, click on the CIPF website.

Your money is working hard for you everyday.

Active vs Passive

Active investing is a hands-on approach of actively buying and selling individual Stocks/ETFs to time the market.

Passive investing refers to as you are investing for the long term. Passive investors usually follow the buy-and-hold strategy. Your money is working hard for you every day on the up days and the down days.

I am a big advocate of a buy-and-hold strategy. However, I do look at individual companies from time to time. Wealthsimple is excellent for a set it and forget it type of investor. The service mainly uses the stock ETFs and bond ETFs with an option to do all equity with Halal investing.

Who is eligible?

Wealthsimple is currently available in 3 countries, Canada, the UK, and the USA.

- You have to be a resident of the above-stated countries

- You have to be of legal age.

In Canada, if you are a foreign national, you can still open an account with a valid study permit or a work permit. I was on a study permit when I opened my account.

The Experience

My experience has been smooth, and I have not yet experienced any issue as of recent. To make things clear, Wealthsimple is not free of any glitches, but they are so tiny that they are negligible since the purpose is not to check the website every day.

No headaches sign ups

Sign up process

The sign-up process is breezy. Just like the above photo suggests, it takes about 5 minutes to get started. Honestly, I was first skeptical of how speedy it would be, but I am impressed.

No matter if you sign up using your mobile device or your desktop, the service provides the same snappy experience. What I’ll say is that I did not have a headache while setting up the account.

The web app

I enjoy their web experience as it does provide me with more information on portfolio, funding, and more settings under my name.

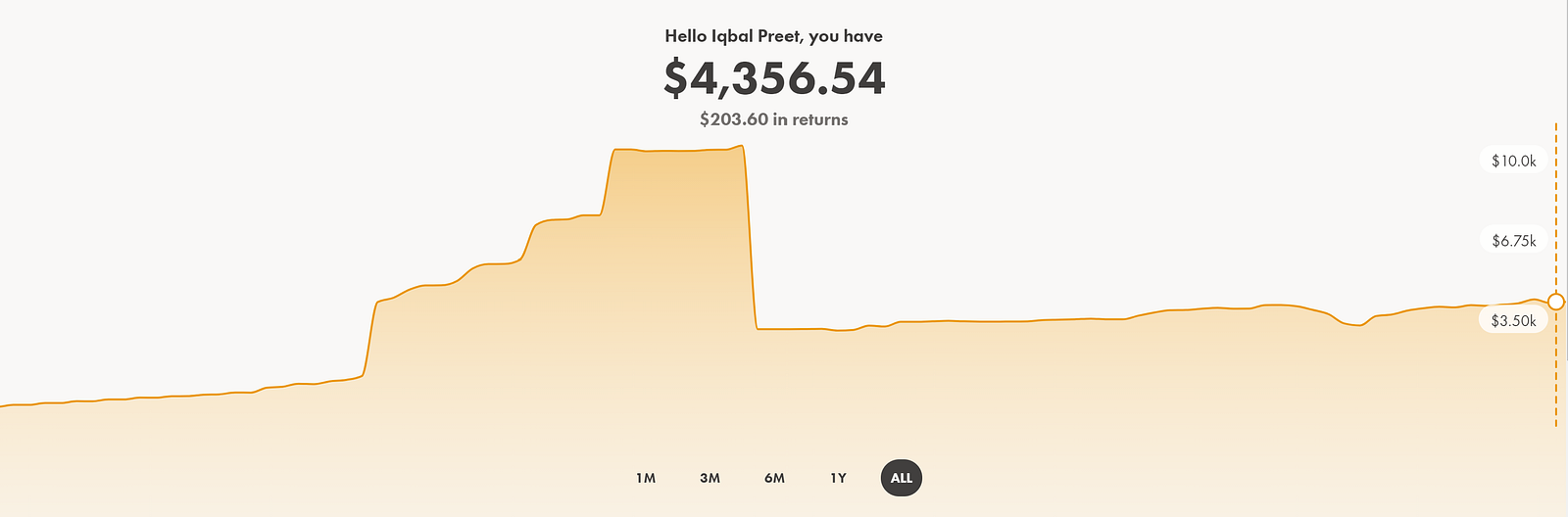

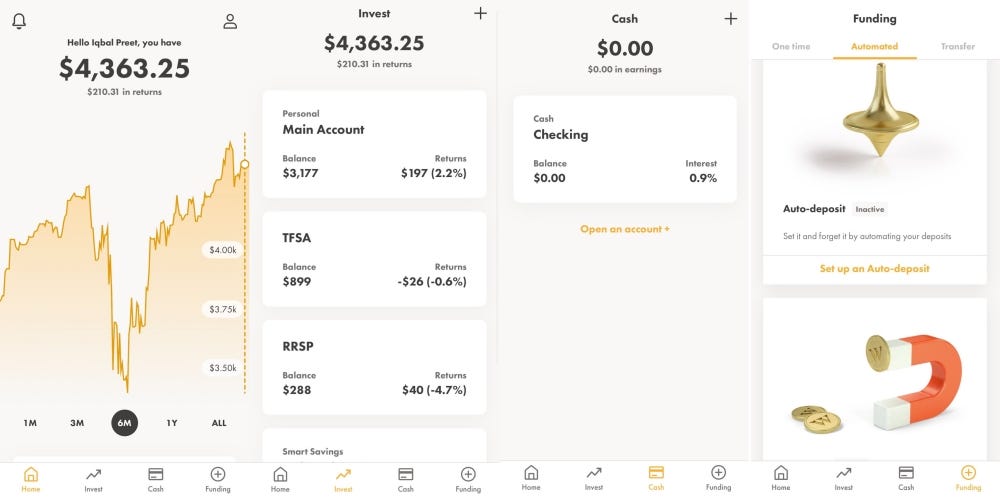

There is a graph showing the collective value of the accounts available in Wealthsimple. With the options of 1M, 3M, 6M, 12M, and All, it shows me how my investment is performing in those periods.

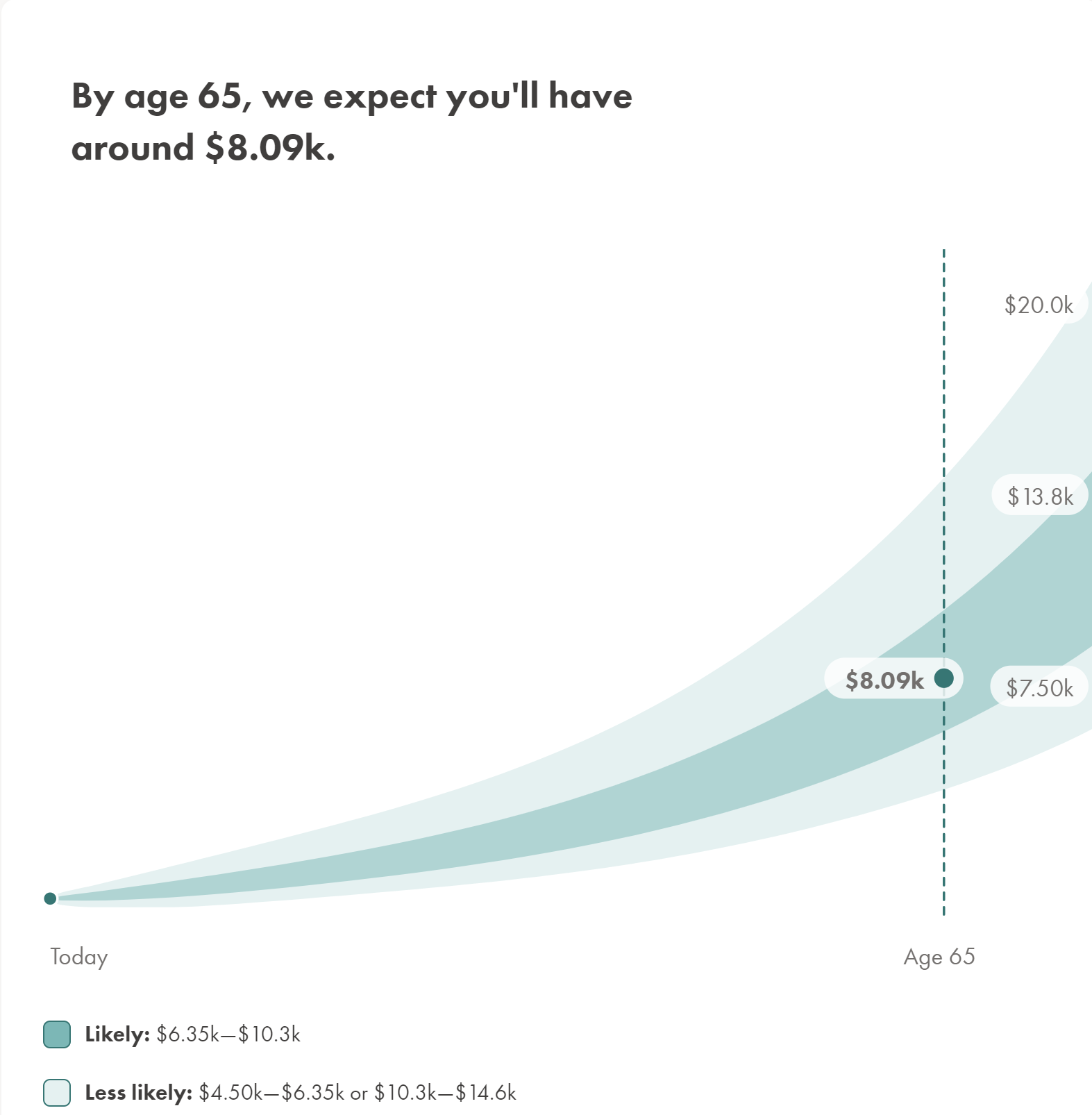

I can go to an individual account as well and see how my accounts are performing. For example, in the image below, it does show how my accounts will look years from now. The projection also shows the likely and less likely scenarios based on the compounding.

Currently, I have $900 in my account. The projections don’t include any future deposits. However, with the shown projections, I feel it might not be an exaggeration to be able to be on the higher spectrum if the portfolio performs well.

The mobile app

Above is the phone app, which is the same on both android and iOS devices. I love the app, and it is intuitive to use when compared to its competitors. *cough* Questrade *cough*. It allows you to navigate the app accounts and enables you to fund the account in 3 ways. I usually turn on auto-deposit. However, it has been a while that I’ve done this due to the Covid-19 irrational market. One downside of the app is that it doesn’t have a dark mode option. I hope they add in soon!

Risk

Wealthsimple allows 10 point risk level adjustment for people from any walk of life. No matter if they are from just starting their investing journey at age 19 or age 52. Wealthsimple caters to everyone with adjustable risk levels.

The good and the bad

Should you invest in?

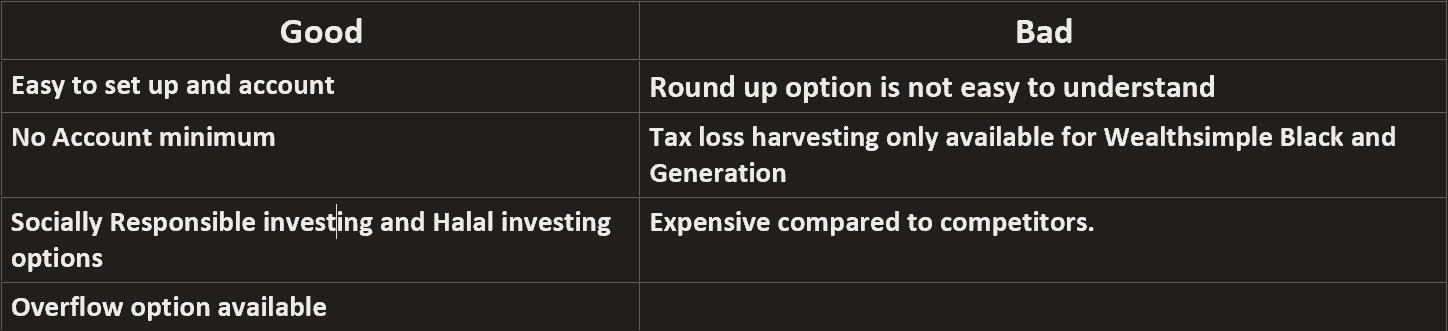

Wealthsimple is an amazing investing tool for passive investors. Ultimately, your goals will define if Wealthsimple is a right till for you or not. I started investing with Wealthsimple invest and have since joined their savings and cash initiative. Honestly, I think you won’t mind paying their management fee of 0.5% for the first $100,000.

If you like the article, you can support me by clicking my referral link. You will get $10,000 managed free for 12 months when you funds your account.

https://wealthsimple.com/invite/NVUFBQ

Comments

Post a Comment